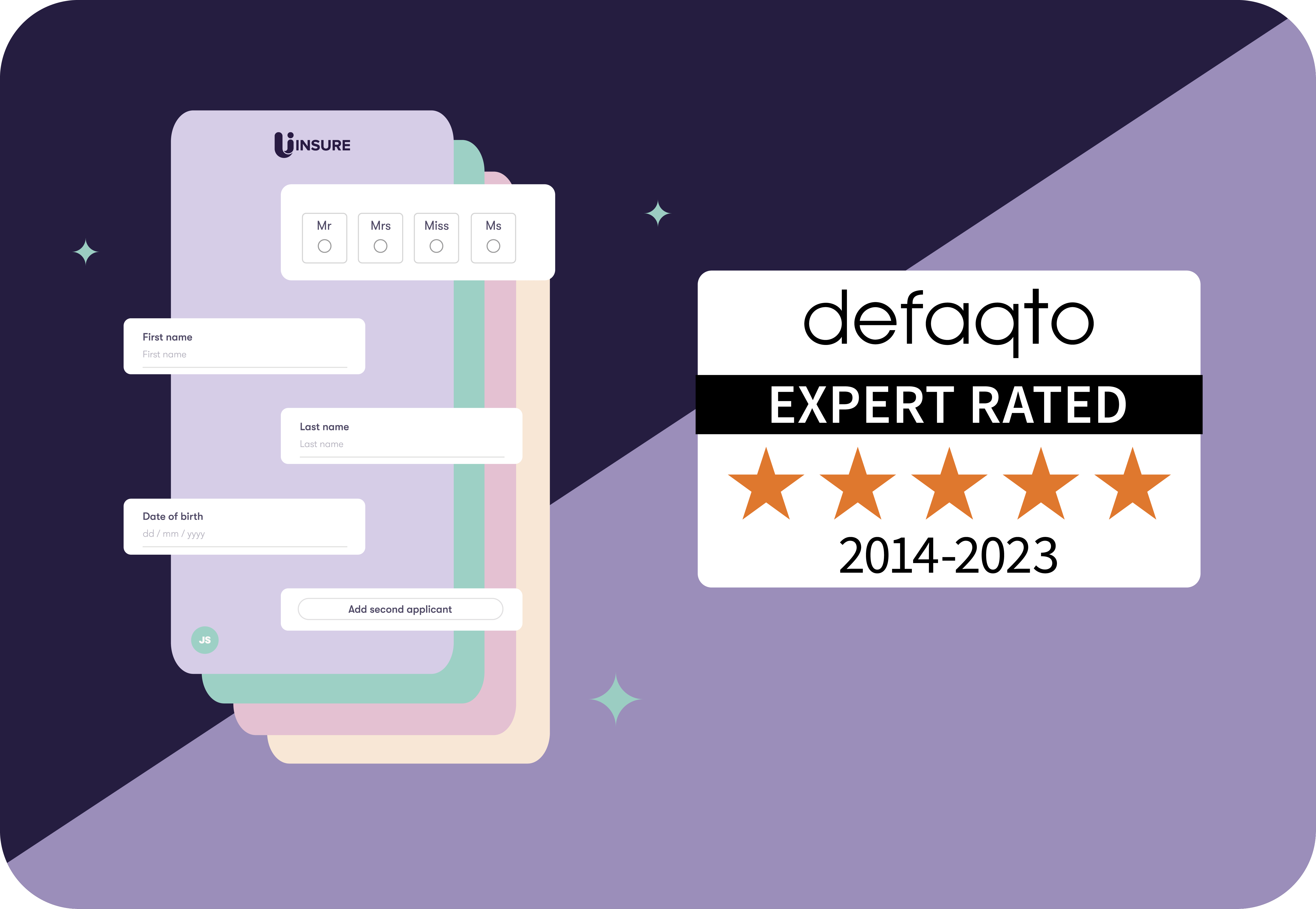

Uinsure have today launched a new tech platform that aims to remove insurance complexity for advisers and their clients. It coincides with the unveiling of a brand refresh for the first time since its inception in 2007.

“Uinsure’s rebrand is not just cosmetic. It represents a maturing of the company, from the inside out that is setting the pace and responding to the demands of our industry by designing the experiences, products and services advisers and their clients expect” said Lauren Bagley, Uinsure’s Chief Distribution Officer.

Lauren continues, “The value that is enabled through our technology is the toughest thing to communicate. Words only means so much – you have to be the words and hence our decision to refresh the brand.

“It’s a major milestone for us as the Uinsure brand becomes synonymous with technology that empowers advisers to provide an insurance experience that kills the complexity that we believe exists in accessing insurance today.”

Martin Schultheiss, Group Managing Director agrees, saying: “Our Adviser Platform introduces innovation that gives advisers the opportunity to outstrip the advantages of direct-to-consumer insurance distributors and deliver greater value to consumers across home, BTL/landlords, non-standard and commercial insurance in one location. Our tech has always been a key differentiator and now that we’ve upgraded this even further, we’re able to be agile, which is now more important than ever against the demand from advisory businesses to digitise their businesses too.

“There’s a big difference between a company that offers technology and actually being a technology company. The latter is the journey that Uinsure has been working towards for the last 36 months. It’s been tough at times; building technology is hard but building technology that makes a difference is even harder. It has required a fundamental shift in culture, structure, process and a complete obsession about our partner and customer needs. We’re now seeing this investment pay off with the delivery of our new Adviser Platform and a refreshed brand to match our ambitions. We’re so excited about the future and this is just the first of several new technology solutions that will be released in 2021.”

The new platform seamlessly enables advisers to receive an insurance quote across home, buy to let and commercial in 3 questions (name, date of birth and postcode) and from there advisers can configure the cover and apply within minutes. It can now be accessed anywhere, on any device and includes features such as giving clients the choice to progress their application in their own time once the quote has been configured, providing clients with an ‘always on’ experience.

In addition to using big data to remove traditional lengthy and complex question sets, it also accesses new build postcode data up to 6 months before postcodes are minted by Royal Mail, meaning advisers can get new build properties insured faster.

Referrals to Uinsure’s GI advisers can now also be made in a few clicks, if the referring adviser does not want to provide the advice themselves. It also has the ability for advisers to flag customer vulnerabilities which then helps Uinsure to deal with clients in the most appropriate way post-sale.

Features of Uinsure’s new Adviser Platform

- Uinsure’s Adviser Platform has removed complex and lengthy questions from its journey using big data and third-party integrations to prefill information and therefore remove the need to rekey or answer complex questions.

- Advisers can deliver a quote in three questions (name, date of birth and postcode) and from there can configure the cover and apply in minutes.

- Advisers can give their clients the choice to progress their application in their own time once the quote has been configured, giving clients an ‘always on’ experience.

- It can provide a seamless, straight through digital experience for all types of properties, even if the circumstances are unusual or non-standard.

- It accesses new build postcode data up to 6 months before postcodes are minted by Royal Mail, meaning advisers can get new build properties insured faster.

- It gives the ability to refer to Uinsure’s GI advisers in a few clicks if the referring adviser does not want to provide the advice themselves.

- It has the ability for advisers to flag customer vulnerabilities which then helps Uinsure to deal with clients in the most appropriate way.

- The pricing methodology reflects the proposed FCA final rules on GI pricing practices, ensuring that existing customers are treated like new customers at renewal.