Tag: redesign2023

Will my insurance policy cover damage to my roof?

Your home’s roof serves as a shield against the elements, protecting you and your loved ones from rain, wind, and – even in the UK – the sun. However, even the most well-maintained roofs can experience unexpected leaks and damage over time. But does home insurance cover roof leaks and repairs? Well, yes, home insurance can cover roof leaks and repairs, but there are things to consider.

What you need to be aware of

Standard policies typically provide coverage for sudden and accidental damage, such as heavy winds, storms or fallen trees and at, Uinsure, we guarantee all repairs for a year.

While home insurance can cover sudden roof damage, it’s crucial to note that routine maintenance and wear and tear are generally not covered. Insurance companies expect homeowners to take reasonable steps to keep their property in good condition. If a leak occurs due to neglect or poor maintenance, the cost of repairs may fall outside the scope of coverage.

What you should do if you notice damage

If you notice a roof leak, it’s important to act quickly. Document the damage with photos and descriptions and report it to your insurance provider as soon as possible.

When you file a claim for roof damage, an insurance adjuster will assess the situation to determine the cause and extent of the damage. If it’s determined that the damage resulted from a covered event and not from neglect, you’ll be able to make a successful claim.

Carefully review your home insurance policy to understand the terms, conditions, and coverage limits related to roof damage. If you’re uncertain about any aspect, reach out to your insurance provider for clarification.

Spook-Proof Your Home: A Guide to Keeping Your Home Safe at Halloween

Malicious damage claims increase by around 20% at Halloween so we’ve prepared a little guidance for how you can keep your home safe at this time of year.

Outdoor Lighting

A well-lit exterior is one of the most best ways to keep unwanted visitors away. If you can, make sure pathways, driveways, and entry points are well-lit. If you have access to motion-activated lighting this will both save energy and also give a bit of a surprise to anyone who approaches your property.

Be a good neighbour

Ask your neighbours to keep an eye on each other’s properties. If the family goes out trick or treating and leaves sweets by the door this is a giveaway for many that no one is home.

Keep Pets Safe

Halloween and then bonfire night can be overwhelming for pets, so it’s essential to keep them safe. Secure them in a quiet, comfortable area away from the front door to prevent them from escaping or getting anxious due to the constant doorbell ringing and visitors and stay with them for as long as you can.

Decorations and Safety

Decorations are an essential part of Halloween for many but it’s vital to make sure flames and candles don’t become serious hazards. Use flameless candles or LED lights in your pumpkins to avoid additional risk.

Door Security

It’s obviously important to keep windows locked but smart doorbells have show up in popularity in recent years too and are a great form of added protection. Plus, you’ll get a sneak peak of your trick or treaters…

Secure Gates and Fences

Check that your gates and fences are in good condition as they’re the first hurled for any uninvited guests.

Window Shopping

If you get tonnes of trick or treaters then you’ll also have plenty of people getting up close to your house. Keep valuable objects out of sight just in case you’re unfortunate enough to have someone who’s up to no good snooping around…

But above all – have fun. Despite malicious damage claims increasing at this time of year, they’re still rare and with good preparation you can minimise any risk.

Happy Halloween!

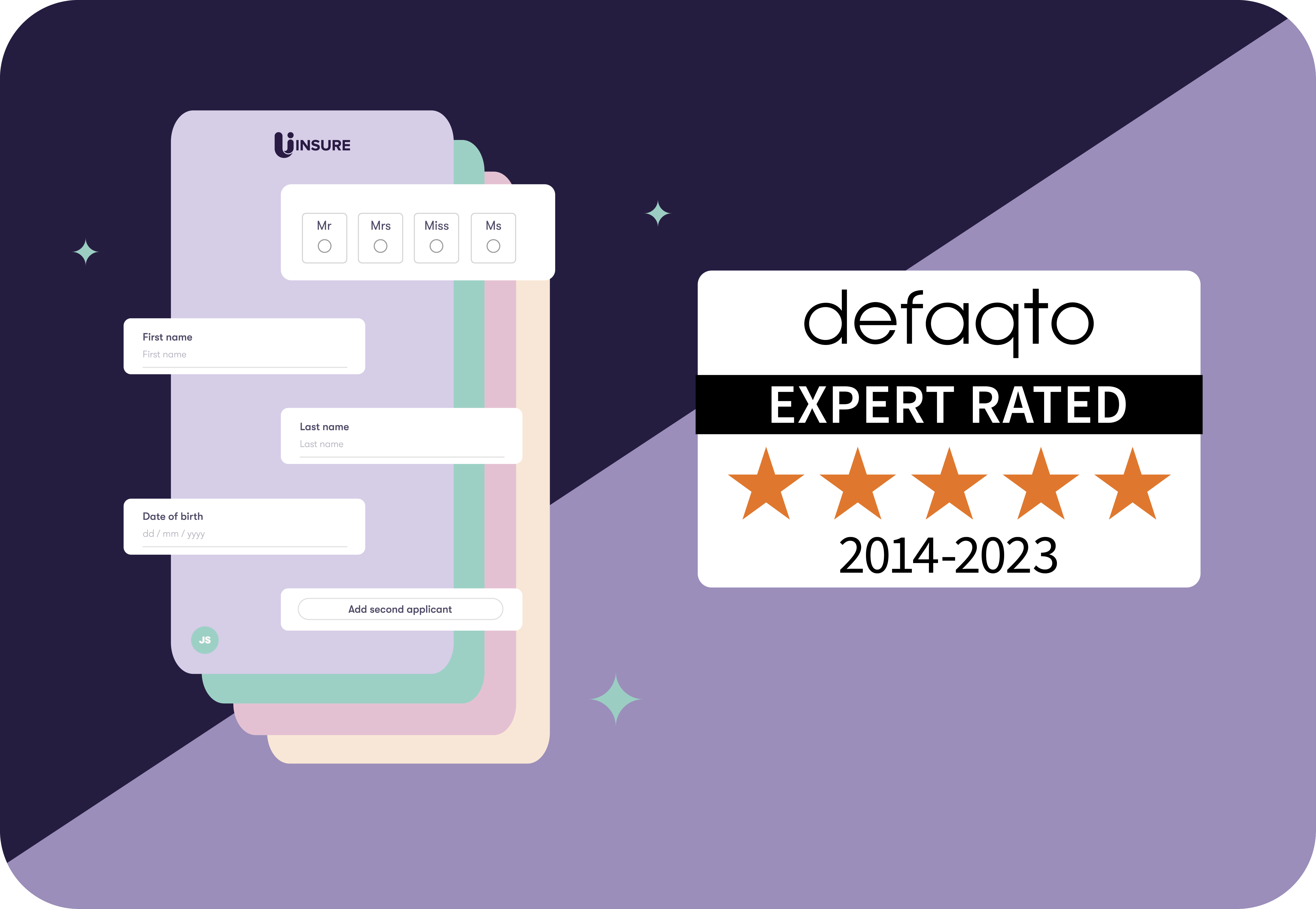

Uinsure has been awarded a Defaqto 5 Star rating for its home insurance policies for a tenth consecutive year.

Its BTL / Landlord products have also been awarded the highest Defaqto 5 Star rating for the ninth year in a row.

The Defaqto 5 Star rating is integral as it gives advisers and their customers the confidence to know that they’re well covered should the unfortunate happen and they

Defaqto, an independent body, rates policies based on all of the key features and benefits on offer, as well as any optional add-ons or extras, before giving an overall rating.

The aim of the service is to ultimately give consumers an impartial and easy-to-understand assessment of an insurance product to help them weigh up benefits before purchasing.

Advisers can utilise Uinsure’s Adviser Platform that has removed the complexities associated with GI to arrange Defaqto 5 Star rated cover.

The hugely simplified quote and application process allows advisers to arrange one of the most comprehensive policies on the market in under a minute.

To demonstrate value and quality of cover to your clients over price, use the Defaqto Compare tool here.

Why I chose B2B InsurTech the next chapter in my career

By Lauren Bagley

When you think of general insurance (GI) advice in the intermediary world, it’s invariably the third or fourth priority for most regulated firms. So why would I choose B2B insurtech?

To put it simply, I chose this career to challenge the status quo in an area with so much opportunity. GI remains an enormous and relatively untapped lever for growth across pretty much all advisory businesses.

The Systemic Conundrum

The big conundrum is that every customer needs at least buildings insurance alongside every mortgage, therefore why is there so much disparity between what the customer needs and what advisory firms offer? I’ve been exposed to this systemic challenge and the various reasons why ever since I began my financial services career. Is this something that can change? I firmly believe so.

More Exciting Things Than Comparing Home Insurance

The decision to join Uinsure in particular, was made even easier because of its tech investment and its ambition to use tech to differentiate itself against a very saturated and traditional marketplace. We’re not short of insurance distributors and manufacturers in the intermediary market and those that recognise the power of data, digital journeys and technology to deliver against continually evolving consumer wants, needs and expectations will ultimately help solve the aforementioned “conundrum”. Plainly speaking, I think we can all agree that there’s plenty more exciting things to spend our time on than comparing home insurance – so let’s make it easier, faster and overall more effective. All I would add here is watch this space.

A Redefining Experience

The obsession Uinsure shares in relation to customer experience also drew me. For example, its belief that customers should not be expected to remember their renewal date to maintain a competitive premium. For far too long the industry has labelled “savvy” customers as those who are consistently scouring the market to find the best deal each year, but why should anyone be expected to do that? This mindset of customer centricity is absolutely where innovation starts to happen.

Advisers Have the Advantage

And then there’s the biggest shake up in the insurance market for decades. Following the FCA’s recent GI Pricing Practice proposals, there’s an expectation that pricing will equalise considerably across direct, aggregator and intermediary channels, as a result of the proposed ban on “price walking”. In a nutshell I think this will mean that advisory firms can make headway in a fairer market and will naturally start to capture more market share.

More so than any brands on the planet – advisory firms are a trusted voice to loyal customers and certainly best positioned to make sure that home insurance needs are covered and up to date. Firms also have the first indication that home insurance may be needed – so we should not give up that opportunity to others.

If you’ve managed to get this far in the article (!), thanks for reading and if you have any questions or thoughts, please feel free to share, comment or drop a message.

Share this

Recent Posts

How to create saleable value from GI

Q&A: All Change

How to create saleable value from GI

Q&A: All Change

Uinsure launches new tech platform

A fully advised service is a necessity

By Martin Schulthiess

ComparetheMarket recently launched a range of online execution-only remortgages with two of the largest lenders in the UK. I’m sure this headline will have grabbed the attention of anyone that leads a mortgage firm and intends to grow their business over coming years and quite rightly so.

In fact, if you log on to any well-known price comparison website, you’ll find that it’s not just insurance products that are part of their overall game plan. Next to the usual compare home insurance or travel insurance buttons, you’ll see options for protection, conveyancing and now also unsurprisingly, a pathway to self-serve a remortgage.

Last year, around 600,0000 people who had been advised on a mortgage by a firm like you, found their home insurance elsewhere. Furthermore, these sites have also collected upwards of 60 personal and property data fields per quote, providing vast intelligence to market your clients with sophisticated, highly personalised communications to deepen that new founded relationship.

Today’s reality is that most people choose financial advisers to arrange a mortgage, but this does not rule out how much power online brands are gaining by building relationships with a footfall of your clients who seek wider product advice alongside their mortgage. From home insurance to conveyancing, these products are a likely need of your client throughout the homebuying process, if not a legal requirement of the mortgage. It therefore makes a lot of sense for advisory businesses to take these products more seriously to make sure they’re delivering against their client needs.

Mortgage advice certainly opens the door to the potential of building a successful business, but what is becoming more apparent to me is that the breadth of service across wider product areas, is the key to protecting and retaining a loyal and longstanding client base which is well-served. Frankly, I believe it’s a necessity to build sustainable and long-lasting client relationships in 2021 and beyond.

The irony is that innovation in home insurance and conveyancing technology for intermediaries has moved much faster than many direct-to-consumer services. I can’t stress enough that it’s not about spending more hours working, late nights filling in forms or rekeying data. The answer is to choose the right technology partner, who can tangibly evidence their capability to integrate and embed these services within your business.

So, if I asked you now to consider offering wider financial services and advice to your clients, would you?

Share this

Recent Posts

How to create saleable value from GI

Q&A: All Change

How to create saleable value from GI

Q&A: All Change

Uinsure launches new tech platform

Uinsure launches new tech platform

By Lauren Bagley

https://youtu.be/cmUH7as7BKk

Uinsure have today launched a new tech platform that aims to remove insurance complexity for advisers and their clients. It coincides with the unveiling of a brand refresh for the first time since its inception in 2007.

“Uinsure’s rebrand is not just cosmetic. It represents a maturing of the company, from the inside out that is setting the pace and responding to the demands of our industry by designing the experiences, products and services advisers and their clients expect” said Lauren Bagley, Uinsure’s Chief Partnerships & Marketing Officer.

Lauren continues, “The value that is enabled through our technology is the toughest thing to communicate. Words only means so much – you have to be the words and hence our decision to refresh the brand.

“It’s a major milestone for us as the Uinsure brand becomes synonymous with technology that empowers advisers to provide an insurance experience that kills the complexity that we believe exists in accessing insurance today.”

Martin Schulthiess, Chief Commercial Officer agrees, saying: “Our Adviser Platform introduces innovation that gives advisers the opportunity to outstrip the advantages of direct-to-consumer insurance distributors and deliver greater value to consumers across home, BTL/landlords, non-standard and commercial insurance in one location. Our tech has always been a key differentiator and now that we’ve upgraded this even further, we’re able to be agile, which is now more important than ever against the demand from advisory businesses to digitise their businesses too.

“There’s a big difference between a company that offers technology and actually being a technology company. The latter is the journey that Uinsure has been working towards for the last 36 months. It’s been tough at times; building technology is hard but building technology that makes a difference is even harder. It has required a fundamental shift in culture, structure, process and a complete obsession about our partner and customer needs. We’re now seeing this investment pay off with the delivery of our new Adviser Platform and a refreshed brand to match our ambitions. We’re so excited about the future and this is just the first of several new technology solutions that will be released in 2021.”

The new platform seamlessly enables advisers to receive an insurance quote across home, buy to let and commercial in 3 questions (name, date of birth and postcode) and from there advisers can configure the cover and apply within minutes. It can now be accessed anywhere, on any device and includes features such as giving clients the choice to progress their application in their own time once the quote has been configured, providing clients with an ‘always on’ experience.

In addition to using big data to remove traditional lengthy and complex question sets, it also accesses new build postcode data up to 6 months before postcodes are minted by Royal Mail, meaning advisers can get new build properties insured faster.

Referrals to Uinsure’s GI advisers can now also be made in a few clicks, if the referring adviser does not want to provide the advice themselves. It also has the ability for advisers to flag customer vulnerabilities which then helps Uinsure to deal with clients in the most appropriate way post-sale.

Features of Uinsure’s new Adviser Platform

- Uinsure’s Adviser Platform has removed complex and lengthy questions from its journey using big data and third-party integrations to prefill information and therefore remove the need to rekey or answer complex questions.

- Advisers can deliver a quote in three questions (name, date of birth and postcode) and from there can configure the cover and apply in minutes.

- Advisers can give their clients the choice to progress their application in their own time once the quote has been configured, giving clients an ‘always on’ experience.

- It can provide a seamless, straight through digital experience for all types of properties, even if the circumstances are unusual or non-standard.

- It accesses new build postcode data up to 6 months before postcodes are minted by Royal Mail, meaning advisers can get new build properties insured faster.

- It gives the ability to refer to Uinsure’s GI advisers in a few clicks if the referring adviser does not want to provide the advice themselves.

- It has the ability for advisers to flag customer vulnerabilities which then helps Uinsure to deal with clients in the most appropriate way.

- The pricing methodology reflects the proposed FCA final rules on GI pricing practices, ensuring that existing customers are treated like new customers at renewal.

Book a demo

Fill in the form below to book a demo on our Adviser Platform.

Share this

Recent Posts

How to create saleable value from GI

Q&A: All Change

How to create saleable value from GI

Q&A: All Change

Uinsure launches new tech platform

Q&A: All Change

By Martin Schulthiess

BestAdvice (BA): What have been the traditional problems with accessing insurance products?

Martin Schultheiss (MS): From our perspective, there are a few key challenges that advisers are facing. The first one would be time. In my previous role, (Schultheiss was group managing director of Sesame Bankhall Group before joining Uinsure) we undertook an exercise that essentially worked out all that was required by advisers to do mortgage/protection/GI – to provide the full stack of advice. We got up to around 100 questions or pieces of data that had to be collected. And I did it myself; it took up three hours of administration and that was without actually doing the advice! It shows that the time it takes to do give full advice is a real challenge.

Advisers have to input multiple pieces of data repeatedly, often across multiple systems and with multiple passwords and then logins, completely rekeying all the time. It just takes too long, it’s not practical.

Secondly, particularly in the case of home insurance, is how challenging it has been for advisers to compete with price comparison websites. It’s well-documented now how price comparison websites and others have been able to win adviser’s clients by discounting new business premiums and then over a period of time raise prices by anything up to 50% over a 3-5 year period. This practice is often referred to as ‘price walking’, whereby the premium is artificially discounted in order to capture the attention of the customer, but the intent is to make up that loss by hiking renewal premiums in subsequent years.

So, with new regulation coming in that proposes to ban this practice, we should start to see a more level price playing field, I think now’s the time for the adviser to develop confidence and to get back to having the conversation with their clients.

From a consumer perspective, I would argue there is a level of knowledge and skill required for an individual to navigate their insurance needs if they do it themselves. Again on popular online sites, you’ve got multiple questions, multiple product providers, decisions on multiple features and benefits, so it’s not as simple as it might seem. Advisers have a compelling value proposition through their advised service and should be thinking about taking that hassle away.

BA: So, presumably that’s what drove you to design a tech-based solution for advisers? How are you doing things differently and what effect will it have on an adviser’s time?

MS: First and foremost Uinsure has been on a journey of moving from being a business that manufactures products which are accessed via technology, to becoming a technology company. Our rebrand comes after having made the strategic decision to deliver insurance technology that removes the complexity we believe exists today for the benefit of advisers and their clients. That’s not an easy thing to do, by the way.

We understand that time is key. So, in three questions, advisers should be able to search the market with Uinsure, and then provide a policy in less than 60 seconds. We use data and technology to do this, allowing advisers to give advice while cutting out as much administration as possible.

General Insurance give the adviser permission to engage with the customer every single year [as it is annually renewable], which to me is probably the greatest asset an adviser could have, particularly in a world with longer term fixed rates that are reducing the frequency of engagement within a client base.

Through our tech we deliver a single common policy, with a 5 Star rating; something that’s simple to understand and not complex and all our insurers then compete to deliver the best price based on that property risk. The key is that the price is fair for the lifetime of the policy, we also review this annually to ensure the customer has the most competitive new business price at every renewal.

We’re not the cheapest because we offer a high quality product and we have never offered introductory cut price offers with the intent to hike at subsequent renewals. In fact, we’re probably one of a very small number of companies that deliver negative premium reduction on an annual basis. I see this as a point that advisers should be talking to their clients about, in contrast to what they may receive elsewhere.

BA: What are the biggest pressures advisers face in the future and how can they address them now?

MS: There are two key things that are going on in the market right now. One is that customers are coming to advisers because they trust them and want to be guided through the process, which in itself philosophically places the onus on us to do a ‘full stack’ job for that customer.

Secondly, customers are giving price comparison websites an enormous amount of permission to harvest their data and, in harvesting their data, to use it to offer other products going forward, which in itself creates an enormous risk for the adviser and the protection of their customer base; those comparison websites are offering general insurance, conveyancing, remortgaging, critical illness, income protection, life cover and execution only mortgages, all of which form the product suite of an adviser firm.

So if nothing else, an adviser should be offering a fully comprehensive service to protect the customer and preserve the relationships of their customers. This is against allowing their customers to leave data footprints all over comparison websites that are getting them to agree to privacy statements that will clearly offer a clear and present danger to the existence of the adviser’s business going forward.

BA: When advisers are reviewing technology solutions, what should they be looking for?

MS: In the beginning of my career, technology meant the guy that came to fix my laptop when it wasn’t working. It wasn’t the essence of the core strategy. Today, for me, it’s now people, culture, technology and data; so, the first thing I would say is that it requires a completely new skill set.

Secondly, there’s a very big difference between traditional companies in manufacturing of products and services that claim to offer technology, versus companies that are technology companies which offer products and services. There’s some subtlety there, but it describes an enormous difference.

From a Uinsure perspective, it’s taken us the better part of three years to get to this moment [with the brand and new platform].

I would say to someone looking at a technology company that trust is fundamental. Make sure that the management teams of those technology companies are a combination of what we call “suits and trainers” – techies and people with industry knowledge. Make sure that there’s a good combination in the team of people that understand your business, understand the challenge you’ve got and understand what’s important to you and your customers. They should also have ‘been there’ and experienced it as well. There’s also whether they have leading edge technology capability inside of their management team to deliver.

In addition, there’s no such thing as a single answer to technology. For me, the most important thing is partnering with technology companies that have architectures that are easily integrated, so that you can combine a couple of platforms to formulate an end to end customer experience.

Advisers need to make sure that technology firms solve their problems and in a way that that gets what they need out of their business.

Share this

Recent Posts

How to create saleable value from GI

Q&A: All Change

How to create saleable value from GI

Q&A: All Change

Uinsure launches new tech platform